A Figure the Government Sets to Reflect the Minimum Income Required to Support a Family

Official Poverty Measure out

The Census Agency determines poverty status by using an official poverty measure (OPM) that compares pre-tax cash income against a threshold that is set up at three times the cost of a minimum nutrient diet in 1963 and adapted for family size.

The OPM uses calculations of these three elements—income, threshold, and family—to estimate what percentage of the population is poor.

The official poverty estimates are drawn from the Current Population Survey Annual Social and Economical Supplement (CPS ASEC), which is conducted in February, March, and April with a sample of approximately 100,000 addresses per year.

In 2016, the nigh recent year for which information are available, the OPM national poverty charge per unit was 12.7 percent. At that place were 40.6 million people in poverty.

Supplemental Poverty Measure out

The Census Bureau introduced the Supplemental Poverty Measure or SPM in 2010 to provide an culling view of poverty in the United states of america that improve reflects life in the 21st century, including contemporary social and economic realities and government policy.

As its name suggests, the SPM supplements only does not replace the official poverty measure, which remains the nation's source for official poverty statistics and for determining means-tested program eligibility.

In a side-past-side comparison of the official poverty measure and the SPM, the Demography Bureau notes their differences in measurement units, poverty threshold, threshold adjustments (e.1000., by family size), updating thresholds, and what counts equally resources, summarized in Table 3 below.

| Tabular array 3. Poverty mensurate concepts differ betwixt the official poverty mensurate and the Supplemental Poverty Measure. | ||

| Poverty Measure Component | Official Poverty Measure | Supplemental Poverty Measure |

| Measurement Units | Families (see note) or unrelated individuals | Resource units (official family definition plus whatsoever coresident unrelated children, foster children, and unmarried partners and their relatives) or unrelated individuals (who are not otherwise included in the family unit definition) |

| Poverty Threshold | Three times the cost of a minimum food nutrition in 1963 | Based on expenditures of food, clothing, shelter, and utilities (FCSU) |

| Threshold Adjustments | Vary by family unit size, composition, and historic period of householder | Vary past family unit size and composition, every bit well equally geographic adjustments for differences in housing costs past tenure |

| Updating Thresholds | Consumer Price Alphabetize: All items | Five-twelvemonth moving average of expenditures on FCSU |

| Resource Measure | Gross before-tax cash income | Sum of cash income, plus noncash benefits that resource units can utilize to run into their FCSU needs, minus taxes (or plus tax credits), minus piece of work expenses, medical expenses, and child support paid to another household |

Source: L. Fox, "The Supplemental Poverty Measure: 2016," Current Population Reports P60-261 (RV), Revised September 2017.

Annotation: "Family" as defined by the Census Bureau is "a group of 2 people or more than (one of whom is the householder) related past birth, marriage, or adoption and residing together; all such people (including related subfamily members) are considered equally members of one family unit."

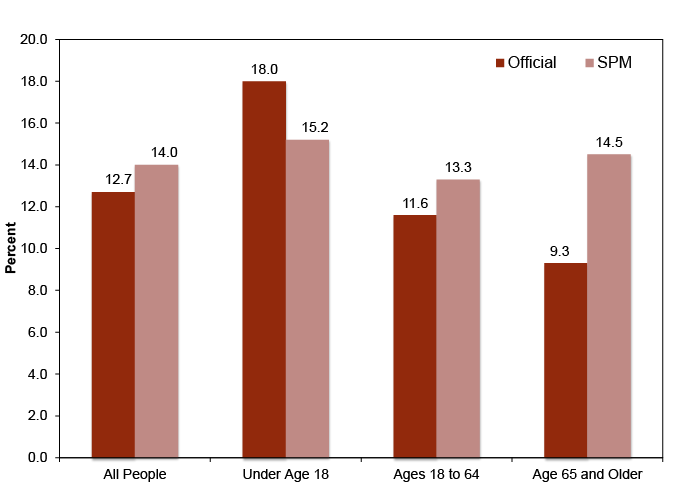

A comparing of official and SPM poverty rates in 2016 for the full population and among three age groups: under age xviii, adults ages 18 to 64, and elders age 65 and over, is shown in Figure two.

For virtually groups, SPM poverty rates were higher than official poverty rates; children are an exception with 15.2 percent poor using the SPM and 18.0 percent poor using the official measure. Analysts attribute the lower SPM kid poverty rate largely to the measure's inclusion of noncash benefits such equally Supplemental Nutrition Assistance Plan (SNAP, formerly Food Stamps) benefits.

The much college SPM poverty rates for people age 65 and older—14.5 percent vs. 9.three percentage using the OPM—partially reflect that the official thresholds are set lower for families with householders in this age group, while the SPM thresholds do non vary by age.

In add-on, the SPM rate is higher for people age 65 and older because it includes out-of-pocket medical expenditures, which are typically high for the elderly, whereas the official measure does not have them into business relationship.

Figure ii. Poverty rates using OPM and SPM measures for full population and by historic period group, 2016, show a higher OPM child poverty rate and higher SPM elderly poverty rates.

welchmomplary1976.blogspot.com

Source: https://www.irp.wisc.edu/resources/how-is-poverty-measured/

0 Response to "A Figure the Government Sets to Reflect the Minimum Income Required to Support a Family"

Post a Comment