An Underwriter Is Reviewing the Medical Questions in the Application

UPDATE: An updated version of this assay based on 2018 data is now bachelor. It includes estimates for non-elderly adults and households, with some breakouts past state, age and gender.

Before private insurance market rules in the Affordable Care Act (ACA) took issue in 2014, health insurance sold in the private marketplace in virtually states was medically underwritten.1 That means insurers evaluated the health status, health history, and other take chances factors of applicants to determine whether and under what terms to upshot coverage. To what extent people with pre-existing health conditions are protected is probable to exist a primal consequence in the fence over repealing and replacing the ACA.

This cursory reviews medical underwriting practices by private insurers in the private health insurance marketplace prior to 2014, and estimates how many American adults could face difficulty obtaining private individual market place insurance if the ACA were repealed or amended and such practices resumed. Nosotros examine data from two big regime surveys: The National Health Interview Survey (NHIS) and the Behavioral Chance Factor Surveillance Organization (BRFSS), both of which tin be used to estimate rates of various wellness atmospheric condition (NHIS at the national level and BRFSS at the land level). We consulted field underwriting manuals used in the individual market prior to passage of the ACA as a reference for commonly declinable conditions.

Estimates of the Share of Adults with Pre-Existing Conditions

Nosotros estimate that 27% of developed Americans under the age of 65 accept wellness weather condition that would likely leave them uninsurable if they applied for individual marketplace coverage under pre-ACA underwriting practices that existed in nearly all states. While a large share of this group has coverage through an employer or public coverage where they do not face up medical underwriting, these estimates quantify how many people could be ineligible for private marketplace insurance under pre-ACA practices if they were to always lose this coverage. This is a conservative estimate as these surveys practice non include sufficient detail on several atmospheric condition that would have been declinable earlier the ACA (such as HIV/AIDS, or hepatitis C). Additionally, millions more accept other conditions that could be either declinable past some insurers based on their pre-ACA underwriting guidelines or grounds for college premiums, exclusions, or limitations nether pre-ACA underwriting practices. In a carve up Kaiser Family Foundation poll, most people (53%) report that they or someone in their household has a pre-existing status.

A larger share of nonelderly women (thirty%) than men (24%) have declinable preexisting conditions. We estimate that 22.eight meg nonelderly men have a preexisting status that would have left them uninsurable in the individual marketplace pre-ACA, compared to 29.iv million women. Pregnancy explains part, but not all of the difference.

The rates of declinable pre-existing conditions vary from state to country. On the low end, in Colorado and Minnesota, at to the lowest degree 22% of non-elderly adults have weather that would likely exist declinable if they were to seek coverage in the individual market under pre-ACA underwriting practices. Rates are higher in other states – particularly in the Due south – such as Tennessee (32%), Arkansas (32%), Alabama (33%), Kentucky (33%), Mississippi (34%), and West Virginia (36%), where at to the lowest degree a tertiary of the not-elderly population would have declinable conditions.

| Table 1: Estimated Number and Percent of Non-Elderly People with Declinable Pre-existing Weather Nether Pre-ACA Practices, 2015 | ||

| State | Percent of Non-Elderly Population | Number of Non-Elderly Adults |

| Alabama | 33% | 942,000 |

| Alaska | 23% | 107,000 |

| Arizona | 26% | 1,043,000 |

| Arkansas | 32% | 556,000 |

| California | 24% | v,865,000 |

| Colorado | 22% | 753,000 |

| Connecticut | 24% | 522,000 |

| Delaware | 29% | 163,000 |

| District of Columbia | 23% | 106,000 |

| Florida | 26% | 3,116,000 |

| Georgia | 29% | 1,791,000 |

| Hawaii | 24% | 209,000 |

| Idaho | 25% | 238,000 |

| Illinois | 26% | 2,038,000 |

| Indiana | 30% | 1,175,000 |

| Iowa | 24% | 448,000 |

| Kansas | 30% | 504,000 |

| Kentucky | 33% | 881,000 |

| Louisiana | xxx% | 849,000 |

| Maine | 29% | 229,000 |

| Maryland | 26% | 975,000 |

| Massachusetts | 24% | 999,000 |

| Michigan | 28% | 1,687,000 |

| Minnesota | 22% | 744,000 |

| Mississippi | 34% | 595,000 |

| Missouri | 30% | 1,090,000 |

| Montana | 25% | 152,000 |

| Nebraska | 25% | 275,000 |

| Nevada | 25% | 439,000 |

| New Hampshire | 24% | 201,000 |

| New Bailiwick of jersey | 23% | ane,234,000 |

| New Mexico | 27% | 332,000 |

| New York | 25% | 3,031,000 |

| North Carolina | 27% | 1,658,000 |

| North Dakota | 24% | 111,000 |

| Ohio | 28% | 1,919,000 |

| Oklahoma | 31% | 706,000 |

| Oregon | 27% | 654,000 |

| Pennsylvania | 27% | two,045,000 |

| Rhode Isle | 25% | 164,000 |

| Southward Carolina | 28% | 822,000 |

| South Dakota | 25% | 126,000 |

| Tennessee | 32% | 1,265,000 |

| Texas | 27% | four,536,000 |

| Utah | 23% | 391,000 |

| Vermont | 25% | 96,000 |

| Virginia | 26% | one,344,000 |

| Washington | 25% | one,095,000 |

| Westward Virginia | 36% | 392,000 |

| Wisconsin | 25% | 852,000 |

| Wyoming | 27% | 94,000 |

| Us | 27% | 52,240,000 |

| SOURCE: Kaiser Family Foundation analysis of data from National Health Interview Survey and the Behavioral Risk Factor Surveillance System. Notation: V states (MA, ME, NJ, NY, VT) had broadly applicative guaranteed access to insurance before the ACA. What protections might be in these or other states nether a repeal and replace scenario is unclear. | ||

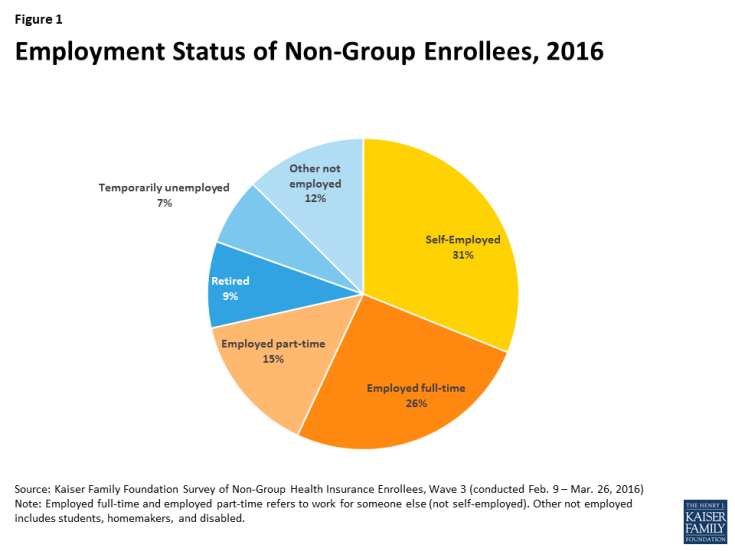

At whatever given time, the vast majority of these approximately 52 million people with declinable pre-existing conditions have coverage through an employer or through public programs like Medicaid. The individual marketplace is where people seek wellness insurance during times in their lives when they lack eligibility for job-based coverage or for public programs such as Medicare and Medicaid. In 2015, about 8% of the non-elderly population had individual marketplace insurance. Over a several-year period, however, a much larger share may seek individual market coverage.ii This market place is characterized by churn, equally new enrollees join and others get out (often for other forms of coverage). For many people, the need for individual market coverage is intermittent, for example, following a 26thursday birthday, job loss, or divorce that ends eligibility for group plan coverage, until they again go eligible for group or public coverage. For others – the cocky-employed, early retirees, and lower-wage workers in jobs that typically don't come with health benefits – the need for individual market coverage is ongoing. (Figure 1 shows the distribution of employment condition among current individual marketplace enrollees.)

Prior to the ACA's coverage expansions, nosotros estimated that 18% of individual marketplace applications were denied. This is an underestimate of the touch on of medical underwriting because many people with health conditions did non apply because they knew or were informed by an agent that they would not be accepted. Denial rates ranged from 0% in a handful of states with guaranteed result to 33% in Kentucky, Northward Carolina, and Ohio. According to 2008 data from America's Health Insurance Plans, deprival rates ranged from virtually v% for children to 29% for adults age 60-64 (over again, not accounting for those who did non apply).

Figure 1: Employment Status of Not-Group Enrollees, 2016

Medical Underwriting in the Individual Market Pre-ACA

Prior to 2014 medical underwriting was permitted in the individual insurance market in 45 states and DC. Applications for private market policies typically included lengthy questionnaires nigh the wellness and risk status of the applicant and all family members to be covered. Typically, applicants were asked to disclose whether they were pregnant or contemplating pregnancy or adoption, and information nearly all physician visits, prescription medications, lab results, and other medical intendance received in the past year. In addition, applications asked almost personal history of a series of health conditions, ranging from HIV, cancer, and middle illness to hemorrhoids, ear infections and tonsillitis. Finally, all applications included authorization for the insurer to obtain and review all medical records, pharmacy database information, and related information.

Once the completed application was submitted, the medical underwriting process varied somewhat beyond insurers, but normally involved identification of declinable medical conditions and evaluation of other conditions or risk factors that warranted other adverse underwriting actions. One time enrolled, a person'due south wellness and risk condition was sometimes reconsidered in a process chosen post-claims underwriting. Although our analysis focuses on declinable medication conditions, each of these other actions is described in more detail beneath.

Declinable Medical Conditions

Before the ACA, individual market insurers in all but five states maintained lists of so-called declinable medical conditions. People with a electric current or past diagnosis of one or more than listed conditions were automatically denied. Insurer lists varied somewhat from company to company, though with substantial overlap. Some of the commonly listed weather are shown in Tabular array 2.

| Table 2: Examples of Declinable Weather In the Medically Underwritten Individual Market place, Before the Affordable Intendance Act | |

| Status | Condition |

| AIDS/HIV | Lupus |

| Alcohol abuse/ Drug abuse with recent treatment | Mental disorders (severe, east.g. bipolar, eating disorder) |

| Alzheimer's/dementia | Multiple sclerosis |

| Arthritis (rheumatoid), fibromyalgia, other inflammatory articulation disease | Muscular dystrophy |

| Cancer inside some flow of time (e.g. ten years, oft other than basal skin cancer) | Obesity, severe |

| Cerebral palsy | Organ transplant |

| Congestive middle failure | Paraplegia |

| Coronary avenue/heart affliction, bypass surgery | Paralysis |

| Crohn's disease/ ulcerative colitis | Parkinson'southward disease |

| Chronic obstructive pulmonary disease (COPD)/emphysema | Pending surgery or hospitalization |

| Diabetes mellitus | Pneumocystic pneumonia |

| Epilepsy | Pregnancy or expectant parent |

| Hemophilia | Sleep apnea |

| Hepatitis (Hep C) | Stroke |

| Kidney disease, renal failure | Transsexualism |

| SOURCE: Kaiser Family Foundation review of field underwriting guidelines from Aetna (GA, PA, and TX), Anthem BCBS (IN, KY, and OH), Assurant, CIGNA, Coventry, Dean Wellness, Gilded Rule, Wellness Care Services Corporation (BCBS in IL, TX) HealthNet, Humana, United HealthCare, Wisconsin Dr. Service. Conditions in this tabular array appeared on declinable conditions list in half or more than of guides reviewed. NOTE: Many additional, less-common disorders likewise appearing on most of the declinable conditions lists were omitted from this table. | |

Our analysis of rates of pre-existing conditions in this brief focuses on those weather that would probable be declinable, based on our review of pre-ACA underwriting documents. Our analysis is limited – and our results are conservative – considering NHIS and BRFSS questionnaires do not address some of the weather condition that were declinable, and in some cases the questions that practice relate to declinable conditions were too broad for inclusion. Run into the methodology section for a list of conditions included in the analysis.

In addition to declinable conditions, many insurers also maintained a list of declinable medications. Current use of any of these medications by an applicant would warrant denial of coverage. Table 3 provides an example of medications that were declinable in one insurer prior to the ACA. Our assay does not endeavour to account for use of declinable medications.

| Table three: Declinable Medications | ||

Anti-Arthritic Medications

| Anti-Diabetic Medications

| Medications for HIV/AIDS or Hepatitis

|

Anti-Cancer Medications

| Anti-Psychotics, Autism, Other Central Nervous Organisation Medications

| |

Anti-Coagulant/Anti-Thrombotic Medications

| Miscellaneous Medications

| |

| SOURCE: Bluish Cross Blueish Shield of Illinois, Product Guide for Agents | ||

Some private market insurers besides developed lists of ineligible occupations. These were jobs considered sufficiently high chance that people so employed would be automatically denied. In addition, some would automatically deny applicants who engaged in certain leisure activities and sports. Table 4 provides an example of declinable occupations from one insurer prior to the ACA. Our analysis does not effort to business relationship for declinable occupations.

| Table 4: Ineligible Occupations, Activities | ||

| Active armed forces personnel | Iron workers | Professional person athletes |

| Air traffic controller | Constabulary enforcement/detectives | Sawmill operators |

| Aviation and air transportation | Loggers | Scuba divers |

| Blasters or explosive handlers | Meat packers/processors | Security guards |

| Bodyguards | Mining | Steel metallic workers |

| Crop dusters | Nuclear industry workers | Steeplejacks |

| Firefighters/EMTs | Offshore drillers/workers | Strong man competitors |

| Hang gliding | Oil and gas exploration and drilling | Taxi cab drivers |

| Chancy material handlers | Pilots | Window washers |

| SOURCE: Preferred One Insurance Company Individual and Family unit Insurance Application Course | ||

Other Adverse Underwriting Actions

Beyond the declinable conditions, medications and occupations, underwriters also examined individual applications and medical records for other weather condition that could generate pregnant "losses" (claims expenses.) Amidst such conditions were acne, allergies, anxiety, asthma, basal cell skin cancer, low, ear infections, fractures, high cholesterol, hypertension, incontinence, joint injuries, kidney stones, menstrual irregularities, migraine headaches, overweight, restless leg syndrome, tonsillitis, urinary tract infections, varicose veins, and vertigo. One or more adverse medical underwriting deportment could consequence for applicants with such conditions, including:

- Rate-up – The applicant might be offered a policy with a surcharged premium (e.g. 150 percent of the standard rate premium that would be offered to someone in perfect health)

- Exclusion passenger – Coverage for handling of the specified condition might be excluded under the policy; alternatively, the body part or arrangement affected by the specified status could be excluded nether the policy. Exclusion riders might be temporary (for a menstruum of years) or permanent

- Increased deductible – The applicant might be offered a policy with a college deductible than the ane originally sought; the college deductible might utilize to all covered benefits or a condition-specific deductible might exist practical

- Modified benefits – The applicant might be offered a policy with certain benefits limited or excluded, for case, a policy that does not include prescription drug coverage.

In some cases, individuals with these conditions might too be declined depending on their health history and the insurer's general underwriting arroyo. For example, field underwriting guides indicated unlike underwriting approaches for an applicant whose kid had chronic ear infections:

- Ane large, national insurer would issue standard coverage if the child had fewer than five infections in the past year or ear tubes, only apply a 50% rate up if there had been more than 4 infections in the prior year;

- Another insurer, which used a 12-tier rate system, would upshot coverage at the 2d nigh favorable rate tier if the child had just i infection in the prior year or ear tubes, at the 5th rate tier if there had been 2-three infections during the prior year, and at the seventh tier if there had been 4 or more infections; for some weather condition, this visitor's rating might depend on the plan deductible – applicants with history of ear infections would be offered the second rating tier for policies with a deductible of $v,000 or college;

- Another insurer would issue standard coverage if the child had merely one infection in the prior year or if ear tubes had been inserted more than one-year prior, apply a rate up if there were two infections in the prior yr, and decline the application if there were three or more infections;

- Another insurer would consequence standard coverage if the child had fewer than three infections in the past twelvemonth, merely outcome coverage with a condition specific deductible of $5,000 if there had been three or more than infections or if ear tubes had been inserted.

In a 2000 Kaiser Family unit Foundation written report of medical underwriting practices, insurers were asked to underwrite hypothetical applicants with varying health conditions, from seasonal allergies to situational low to HIV. Results varied significantly for less serious conditions. For case, the applicant with seasonal allergies who made 60 applications for coverage was offered standard coverage 3 times, declined 5 times, offered policies with exclusion riders or other benefit limits 46 times (including three offers that excluded coverage for her upper respiratory organisation), and policies with premium rate ups (averaging 25%) 6 times.

Pre-existing Condition Exclusion Provisions

In addition to medical screening of applicants before coverage was issued, most individual market policies likewise included more full general pre-existing condition exclusion provisions which limited the policy'south liability for claims (typically within the first yr) related to medical weather that could be determined to exist prior to the coverage taking effect.3

Case of pre-existing condition exclusion

Jean, an Arizona instructor whose employer provided group health benefits but did not contribute to the cost for family members, gave nascency to her daughter, Alex, in 2004 and soon after practical for an individual policy to cover the infant. Due to time involved in the medical underwriting process, the baby was uninsured for near 2 weeks. A few months afterward, Jean noticed swelling around the baby's face up and eyes. A specialist diagnosed Alex with a rare congenital disorder that prematurely fused the basic of her skull. Surgery was needed immediately to avoid permanent brain damage. When Jean sought prior-authorization for the $xc,000 process, the insurer said it would not exist covered. Nether Arizona police force, whatever condition, including congenital atmospheric condition, that existed prior to the coverage effective date, could be considered a pre-existing status under private market place policies. Alex's policy excluded coverage for pre-existing conditions for one year. Jean appealed to the land insurance regulator who upheld the insurer'south exclusion as consistent with state law.

Source: Wall Street Journal, May 31, 2005

The nature of pre-existing condition exclusion clauses varied depending on land law. In nineteen states, a health condition could only exist considered pre-existing if the individual had actually received treatment or medical communication for the status during a "lookback" period prior to the coverage effective date (from half-dozen months to v years). In well-nigh states, a pre-existing condition could also include 1 that had non been diagnosed only that produced signs or symptoms that would prompt an "ordinarily prudent person" to seek medical advice, diagnosis or treatment. In 8 states and DC, weather condition that existed prior to the coverage effective appointment – including those that were undiagnosed and asymptomatic – could exist considered pre-existing and and so excluded from coverage under an private marketplace policy. For example, a congenital condition in a newborn could be considered pre-existing to the coverage effective appointment (the babe's birth date) and excluded from coverage. Nearly half of the states required individual market place insurers to reduce pre-existing status exclusion periods by the number of months of an enrollee'southward prior coverage.

Example of policy rescission

Jennifer, a Colorado preschool instructor, was seriously injured in 2005 when her car was hit by a drug dealer fleeing the police. She required months of inpatient hospitalization and rehab, and her bills reached $185,000. Jennifer was covered past a non-grouping policy which she had purchased five months prior to the accident. Shortly after her claims were submitted, the insurer re-reviewed Jennifer's application and medical history. Post-obit its investigation, the insurer notified Jennifer they found records of medical care she had non disclosed in her application, including medical advice sought for discomfort from a prolapsed uterus and an ER visit for shortness of breath. The insurer rescinded the policy citing Jennifer's failure to disclose this history. Jennifer sued the insurer for bad faith; four years subsequently a jury ordered the insurer to reinstate the policy and pay $37 meg in damages.

Source: Westword, Feb xi, 2010.

Unlike exclusion riders that express coverage for a specified condition of a specific enrollee, pre-existing condition clauses were general in nature and could touch coverage for whatever applicable condition of any enrollee. Pre-existing condition exclusions were typically invoked post-obit a process called post-claims underwriting. If a policyholder would submit a claim for an expensive service or condition during the first year of coverage, the individual market place insurer would conduct an investigation to determine whether the condition could be classified as pre-existing.

In some cases, post-claims underwriting might besides result in coverage beingness cancelled. The investigations would likewise examine patient records for bear witness that a pre-existing condition was known to the patient and should have been disclosed on the application. In such cases, instead of invoking the pre-existing status clause, an issuer might act to rescind the policy, arguing it would have not issued coverage in the start place had the pre-existing status been disclosed.

Discussion

The Affordable Care Human action guarantees admission to wellness insurance in the individual market and ends other underwriting practices that left many people with pre-existing atmospheric condition uninsured or with limited coverage before the law. As discussions become underway to repeal and replace the ACA, this assay quantifies the number of adults who would be at adventure of being denied if they were to seek coverage in the private market under pre-ACA rules. What types of protections are preserved for people with pre-existing weather will be a key element in the debate over repealing and replacing the ACA.

We estimate that at least 52 million non-elderly adult Americans (27% of those nether the age of 65) have a wellness status that would leave them uninsurable nether medical underwriting practices used in the vast majority of state individual markets prior to the ACA. Results vary from state-to-state, with rates ranging around 22 – 23% in some Northern and Western states to 33% or more in some southern states. Our estimates are conservative and do non account for a number of conditions that were often declinable (only for which data are not available), nor do our estimates account for declinable medications, declinable occupations, and weather condition that could atomic number 82 to other adverse underwriting practices (such as higher premiums or exclusions).

While most people with pre-existing atmospheric condition take employer or public coverage at any given time, many people seek individual marketplace coverage at some bespeak in their lives, such equally when they are between jobs, retired, or self-employed.

At that place is bipartisan desire to protect people with pre-existing weather condition, but the details of replacement plans have nonetheless to exist ironed out, and those details will shape how accessible insurance is for people when they have health conditions.

Gary Claxton, Cynthia Cox, Larry Levitt, and Karen Pollitz are with the Kaiser Family Foundation. Anthony Damico is an independent consultant to the Kaiser Family Foundation.

Methods

To calculate nationwide prevalence rates of declinable wellness conditions, we reviewed the survey responses of nonelderly adults for all question items shown in Methods Table 1 using the CDC's 2015 National Health Interview Survey (NHIS). Approximately 27% of 18-64 yr olds, or 52 million nonelderly adults, reported having at least one of these declinable atmospheric condition in response to the 2015 survey. The CDC's National Center for Health Statistics (NCHS) relies on the medical condition modules of the annual NHIS for many of its core publications on the topic; therefore, we consider this survey to be the most accurate means to guess both the nationwide rate and weighted population.

Since the NHIS does not include state identifiers nor sufficient sample size for most state-based estimates, nosotros constructed a regression model for the CDC's 2015 Behavioral Risk Gene Surveillance Arrangement (BRFSS) to estimate the prevalence of any of the declinable atmospheric condition shown in Methods Table one at the land level. This model relied on three highly significant predictors: (a) respondent age; (b) self-reported off-white or poor health condition; (c) self-report of any of the overlapping variables shown in the left-hand column of Methods Table 1. Across the two information sets, the prevalence rate calculated using the analogous questions (i.due east. the left-hand column of Methods Table 1) lined up closely, with xx% of 18-64 twelvemonth erstwhile survey respondents reporting at least one of those declinable conditions in the 2015 NHIS and 21% of 18-64 year olds in the 2015 BRFSS. Applying this prediction model directly to the 2015 BRFSS microdata yielded a nationwide prevalence of whatsoever declinable status of 28%, a almost match to the NHIS nationwide guess of 27%.

| Methods Table ane: Declinable Medical Conditions Bachelor in Survey Microdata | |

| Declinable Status Questions Available in both the 2015 National Health Interview Survey and also the 2015 Behavioral Risk Gene Surveillance System | Declinable Condition Questions Available in only the 2015 National Wellness Interview Survey |

| Always had CHD | Melanoma Peel Cancer |

| Ever had Angina | Any Other Middle Condition |

| E'er had Heart Assault | Crohn'due south Disease or Ulcerative Colitis |

| Ever had Stroke | Epilepsy |

| Ever had COPD | Difficulty Due to Mental Retardation |

| Ever had Emphysema | Difficulty Due to Cerebral Palsy |

| Chronic Bronchitis in past 12 months | Difficulty Due to Senility |

| Ever had Not-Skin Cancer | Difficulty Due to Depression |

| E'er had Diabetes | Difficulty Due to Endocrine Trouble |

| Weak or Declining Kidneys | Difficulty Due to Claret Forming Organ Trouble |

| BMI > twoscore | Difficulty Due to Drug / Alcohol / Substance Corruption |

| Meaning | Difficulty Due to Schizophrenia, Add together, or Bipolar Disorder |

In order to align BRFSS to NHIS overall statistics, we then applied a Generalized Regression Estimator (GREG) to calibration down the BRFSS microdata'due south prevalence rate and population gauge to the equivalent estimates from NHIS, 27% and 52 million. Since the regression described in the previous paragraph already predicted the prevalence rate of declinable conditions in BRFSS by using survey variables shared across the two datasets, this secondary calibration solely served to produce a more bourgeois judge of declinable weather condition by calibrating BRFSS estimates to the NHIS. Afterward applying this calibration, nosotros calculated state-specific prevalence rates and population estimates off of this post-stratified BRFSS sample.

The programming code, written using the statistical computing bundle R 5.3.3.2, is available upon request for people interested in replicating this arroyo for their own analysis.

welchmomplary1976.blogspot.com

Source: https://www.kff.org/health-reform/issue-brief/pre-existing-conditions-and-medical-underwriting-in-the-individual-insurance-market-prior-to-the-aca/

0 Response to "An Underwriter Is Reviewing the Medical Questions in the Application"

Post a Comment